Some Known Questions About Simply Solar Illinois.

Some Known Questions About Simply Solar Illinois.

Blog Article

About Simply Solar Illinois

Table of ContentsThe Ultimate Guide To Simply Solar IllinoisSome Known Facts About Simply Solar Illinois.The smart Trick of Simply Solar Illinois That Nobody is DiscussingSimply Solar Illinois Can Be Fun For EveryoneFacts About Simply Solar Illinois Uncovered

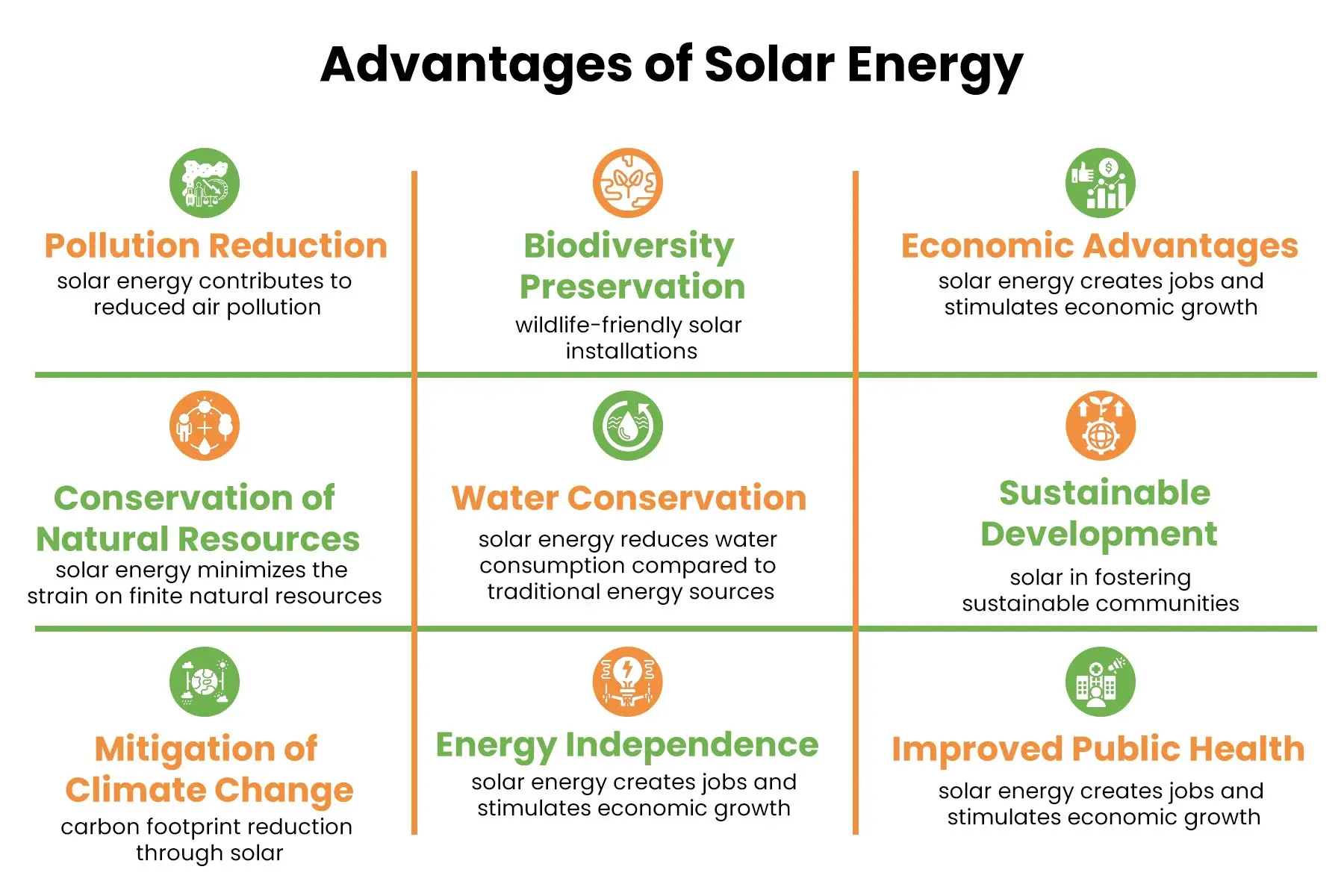

Our group partners with regional communities throughout the Northeast and beyond to supply clean, budget friendly and reliable power to foster healthy communities and keep the lights on. A solar or storage job supplies a variety of benefits to the community it serves. As innovation advancements and the cost of solar and storage decrease, the financial advantages of going solar remain to climb.Support for pollinator-friendly environment Environment restoration on infected sites like brownfields and landfills Much required color for livestock like sheep and fowl "Land financial" for future farming usage and soil top quality enhancements Due to climate change, extreme weather is becoming extra constant and turbulent. As an outcome, house owners, services, communities, and energies are all ending up being an increasing number of thinking about protecting energy supply solutions that supply resiliency and energy protection.

Environmental sustainability is one more essential vehicle driver for organizations spending in solar energy. Several business have robust sustainability objectives that include minimizing greenhouse gas exhausts and utilizing much less sources to aid decrease their effect on the all-natural environment. There is a growing seriousness to deal with climate modification and the stress from consumers, is getting to the leading levels of organizations.

Simply Solar Illinois Things To Know Before You Buy

As we approach 2025, the assimilation of photovoltaic panels in business projects is no more simply a choice however a calculated need. This blogpost explores just how solar power works and the diverse benefits it brings to commercial structures. Solar panels have actually been made use of on residential buildings for years, but it's just recently that they're ending up being much more usual in business building and construction.

In this article we review how solar panels work and the advantages of using solar power in business buildings. Electrical energy prices in the United state are increasing, making it a lot more pricey for companies to operate and extra difficult to plan in advance.

The United State Power Info Administration anticipates electric generation from solar to be the leading resource of development in the U.S. power industry via the end of 2025, with 79 GW of new solar capability predicted ahead online over the next 2 years. In the EIA's Short-Term Energy Expectation, the company said it expects sustainable power's general share of electrical power generation to climb to 26% by the end of 2025

Some Known Details About Simply Solar Illinois

The sunshine website here creates the silicon cell electrons to set in activity, developing an electric existing. The photovoltaic solar battery absorbs solar radiation. When the silicon engages with the sunlight rays, the electrons begin to move and create a flow of straight electric present (DC). The wires feed this DC electricity right into the solar inverter and convert it to rotating power (AIR CONDITIONER).

There are numerous ways to keep solar power: When solar energy is fed into an electrochemical battery, the chemical reaction on the battery components keeps the solar power. In a reverse response, the current departures from the battery storage space for intake. Thermal storage utilizes mediums such as liquified salt or water to retain and absorb the warmth from the sunlight.

This system stores pressed air in big vessels such as tanks or all-natural formations (e.g., caves), after that releases the air to produce electricity. Electricity is one of the greatest recurring expenses that business i was reading this structures have. Photovoltaic panel significantly lower power expenses. While the first financial investment can be high, overtime the cost of installing solar panels is recovered by the money saved on electricity expenses.

Simply Solar Illinois Things To Know Before You Get This

By setting up photovoltaic panels, a brand reveals that it appreciates the atmosphere and is making an effort to decrease its carbon impact. Structures that depend totally on electrical grids are at risk to power failures that occur during bad weather condition or electric system breakdowns. Photovoltaic panel set up with battery systems enable business buildings to remain to operate during power outages.

Simply Solar Illinois - An Overview

Solar power is one of the cleanest kinds of energy. In 2024, home see this owners can benefit from government solar tax rewards, permitting them to counter virtually one-third of the acquisition price of a solar system through a 30% tax obligation credit.

Report this page